Meet the Expert - Dezan Shira & Associates

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors.

Originally incorporated in Hong Kong in 1992, Dezan Shira & Associates is in its third decade of operations and has subsequently grown to support 28 offices and over 300 staff in operations throughout China, Hong Kong, India, Singapore, and Vietnam together with their alliance partners in Indonesia, Malaysia, the Philippines and Thailand. The firm also maintains client liaison offices in the United States and Europe.

About the expert Adam Livermore:

Adam Livermore is an equity partner at Dezan Shira & Associates and specializes in human resources, including the legal, accounting and regulatory issues surrounding employment in China. Adam has co-written a book with colleagues in the Dalian office of Dezan Shira & Associates entitled “Human Resources & Payroll in China 2017-2018.” Born in London, he has been living in China for the past fourteen years and is proficient in Chinese and Japanese.

Do I need a written labor contract?

A written labor contract is required by law in China and is necessary in order to protect both the employee and the employer.

Specifically, a written labor contract will need to be signed within one month of the employee starting work. If the labor contract is not signed within this period, the employee can be entitled to double salary for the period of more than one month but less than one year. If the labor contract is not signed within a year, the contract will be deemed as an open term contract.

What types of labor contracts can I sign and what information should my company’s labor contract contain?

The primary forms of a labor contract in relation to the work term of an employee are:

- Fixed term contracts

- Open term contracts

- Project contracts

The type of contract will affect various aspects of the employment relationship, such as permissible length of probation period and termination conditions. For example, project contracts expire once the project has been completed; while a company can only renew a fixed term contract twice (or have an employee on a fixed term contract for 10 year) before the contract will be required to become an open term contract and requirements for renewal of fixed term contract vary by jurisdiction.

A labor contract must contain the following clauses:

- Name of the company, address, name of the legal representative or a senior manager

- Name of the employee together with a valid address and identification number

- Commencement date and the term of the contract

- Description of the job and the location where it is to be implemented

- Salary details

- Statement that the employer will contribute social insurance for the employee

- Labor protection, labor conditions and protection from occupational hazards

Other optional clauses to contain in the labor contract may include probation period, non-competition clauses, confidentiality clauses, and allowances and benefits (particularly for foreign employees).

Do I need to have a staff handbook and what is its relation to the labor contract?

The staff handbook is not a legally required document; however, it is recommended that a company should have employees sign a staff handbook; which provides supplemental explanations concerning mandatory terms, and makes it easier to demonstrate an employee has broken a company rule in case of a dispute.

The staff handbook will act as the “code of conduct” to help clarify internal rules and procedures of the company; as well as, supplement, in more detail, certain terms of the labor contract and define concepts that may only be vaguely covered under relevant laws. The contents of the handbook will vary by industry.

The staff handbook should be referenced in the labor contract and differentiate between minor and major breaches, and how these breaches will be dealt with.

It is recommended that employees sign to confirm their understanding of the staff handbook and when implementing a new or revised staff handbook a company should go through certain democratic procedures to solicit feedback from employees prior to implementation.

Other than salary, what other employment costs should a company consider for each employee?

In addition to knowing appropriate salary amounts and average annual salary increases for different types of positions in a given industry, which can be considered through a salary benchmark study, a company should also consider statutory contributions for social insurance and housing fund.

Statutory contributions, based on a percentage of an employee’s salary, will be required from the employer and employee for both local and expatriate employees. A notable exception is Shanghai, where contributions are exempt for expatriate employees.

- Specific contribution rates will vary by jurisdiction, but can generally be described as:

- Pension: Employer around 10-22%; Employee around 8%

- Medical: Employer around 5-12%; Employee around 2%

- Unemployment: Employer around 2%; Employee around 1%

- Maternity: Employer around 0.5%-2% ; Employee: N/A

- Work-related Injury: Employer 0.2%-2%; Employee: N/A

- Housing Fund: Employer 5-12%; Employee around 5-12%

Salary amounts used as the basis of calculations for social insurance and housing fund contributions will be capped at three times the local average monthly salary.

Companies not paying or improperly paying social insurance contributions, may face fines or interest on late payments. Moreover, employees have the right to terminate the labor contract and receive severance payment if the employer does not pay social insurance contributions.

A company should also consider possible statutory payments for overtime. Under the standard working hour system, overtime will be paid based on a percentage of the basic hourly salary for each overtime hour:

- On working days: 150%

- On weekends: 200%

- On public holidays: 300%

Under the comprehensive work hour system, overtime will be calculated as:

- Beyond ordinary shift: 150%

- On public holidays: 300%

Overtime policies and application procedures will typically be regulated in the company’s staff handbook.

Under what circumstances can a company terminate an employee and what obligations will a company need to fulfill during termination?

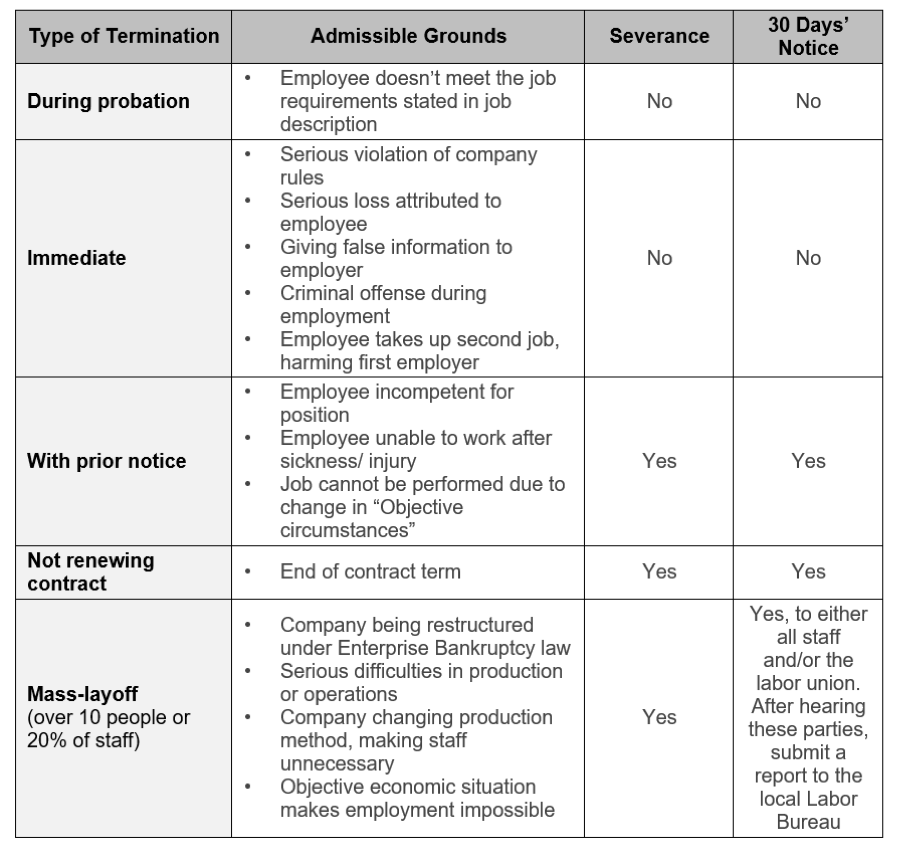

Termination of an employee is only permitted under certain conditions. In general, statutory grounds for termination and basic obligations for termination will be as follows:

Certain types of employees may not be permitted to be terminated and certain local requirements or procedures may need to be met for termination. If a termination does not meet statutory conditions and is deemed to be illegal, the company may be required to pay double severance and/or the termination may be invalidated.

Under termination conditions that require severance, the severance payment amount will be calculated as:

Average Monthly Salary x Years of Employment with Company

The average monthly salary refers to the average compensation of the last 12 months prior to termination and will include salary, bonuses, and other payments to employees. Average monthly salary used for the severance payment calculation will be capped at three times the local average monthly salary.

Additional payments may also need to be paid for untaken leave (e.g. double daily salary for each day of untaken leave), failure to provide 30 days’ notice of termination if required, and/or other factors.

A company may establish certain internal regulations or conduct an HR audit, either done in house or through a 3rd party service provider, to identify existing compliance issues or prevent future exposure. Common focus areas will include:

Compliance: To ensure company is in line with current and local employment requirements and thus minimize future penalties from HR bureaus, including:

- Mandatory social insurance – paid or not; paid in accordance with the correct contribution base/rate or not

- Salary and overtime payment – minimum wage requirements

- Work hour system and overtime payment

- Work safety requirements

- Leaves and holidays

Employment relationship management: To manage the employment relationship to reduce future risk of labor disputes, including:

- Whether the contract is signed in time or not;

- Legitimacy of the contract clauses, such as the probation period, the termination, the confidentiality and non-competition clauses, etc.

- Proper job analysis, including job standards / job description/job specification

- Consistency of the Chinese and English versions of the contract

- Due process of internal rules

- Termination

HR functions: To ensure specific HR functions work well, including:

- Recruiting/selection/training/career development

- Payroll

- Performance appraisals

HR strategy & best practice: To help the organization maintain or improve a competitive advantage, including:

- HR supply and demand situation

- Compensation management: whether the salary structure of the company can attract and retain talent for the company or not Appraisal of the effectiveness of the HR working process

Meet the Expert

The BenCham online knowledge sharing programme - Meet the Expert - is aimed at sharing knowledge from BenCham's members on a variety of topics covering from regulation updates to the release of new policies, from the f&b market to cross border e-commerce and from the One Belt One Road Initiatives to the effect of the Brexit on EU SMEs doing business in China.

Every month we will invite one or two of our member experts to answer the questions you have.